is car loan interest tax deductible 2019

How does tax benefit on Car. An individual can claim a deduction under this section until the repayment of the loan.

What Car Related Tax Deductions Are Available Carvana Blog

It is only allowed to be treated as an expense where the Car is being used for Business purposes.

. In this case neither the business portion nor the personal portion of the interest will be deductible. However LoanMart has competitive interest rates and long repayment terms so you can pay off your loan FAST which can be a much better benefit. No one can only claim a deduction us 80EEB on the interest payment of the loan.

For tax year 2019 the mileage rate is 58 cents per mile. If the vehicle is being used in part for business as an employee and the expenses are being deducted as an itemized deduction. It can also be a vehicle you use for both personal and business purposes but you need to account for the usage.

More on that coming up. The IRS allows you to deduct certain expenses from your total income to arrive at taxable income which is the portion of your earnings that is subject to tax. If a Salaried person takes a Car Loan then he cannot claim the Interest on Car Loan as an expense.

But there is one exception to this rule. It is fairly clear that the interest paid on home loan is allowed as a deduction in all cases. You can also deduct interest on an auto loan registration and property tax fees and parking and tolls in addition to the standard mileage rate deduction as long as you can prove that they are business expenses.

Include the interest as an expense when you calculate your allowable motor vehicle expenses. Interest on car loans may be deductible if you use the car to help you earn income. However the interest paid on car loan is not allowed as an expense in all cases.

Business owners and self-employed individuals. If you are using the actual expenses method you can still deduct expenses like registration fees auto loan interest tolls and parking fees. Remember you can only deduct the business-use percentage of your car.

If you use your car for business purposes you may be able to deduct actual vehicle expenses. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. Types of interest not deductible include personal interest such as.

You can also claim other business-related expenses like depreciation fuel oil maintenance and repairs licenses tires insurance rental. Interest on loans is deductible under CRA-approved allowable motor vehicle expenses. Some of these expenses include your payments of interest on a mortgage and for business loans.

Interest on vehicle loans is not deductible in and of itself. If the vehicle is entirely for personal use. If you use your car for business purposes you may be allowed to partially deduct car loan interest as a business expense.

Car loan interest would be deductible if the vehicle was used for self employment or in the service of an employer but it is not deductible for personal use. During Ronald Reagans time in office he reformed tax laws so that auto loan interest can no longer be tax deductible. The faster you pay off your car title loan the less you will pay in interest.

When you use a passenger vehicle or a zero-emission passenger. Write_off_block Other vehicle tax. Therefore the quick and easy answer to the question is no However some other loan-related expenses are deductible so dont stop at auto loans when searching for deductions.

When you get a car title loan with LoanMart we will work with you to come up with a payment plan using. However if you are buying a car for commercial use you can show the interest paid in a year as an expense and reduce your taxable income. The answer to is car loan interest tax deductible is normally no.

For how many years can I claim a deduction under section 80EEB. To write off your car loan interest youll have to deduct actual car expenses instead of the standard mileage rate. Thus you are not eligible for any deductions on your Car Loan if you are buying for your personal use.

However when you use a credit card for personal purchases the interest you pay is nondeductible. Credit card and installment interest incurred for personal expenses. So if you use your car for work 70 of the time you can write off 70 of your vehicle interest.

Points if youre a seller service charges credit investigation fees and interest relating to tax-exempt income such as interest to purchase or carry tax-exempt. If your state has a general sales tax rate thats lower than its car sales tax you can only deduct the amount you would have paid with the general rate. The tax deduction is only available for the interest component of the loan and not for the principal amount.

Self-employed taxpayers may deduct car loan interest provided they deduct only that portion related to business use of the vehicle. The personal portion of the interest will not be deductible. You would also have to claim actual vehicle expenses rather than the standard mileage rate for your vehicle expenses.

Typically deducting car loan interest is not allowed. This is why you need to list your vehicle as a business expense if you wish to deduct the interest youre paying on a car loan. For example if you bought a car for 10000 and paid 500 in taxes because of the states 5 car sales tax but your state charges a 4 general sales tax you would only be able to deduct 400 on your taxes.

The deduction is based on the portion of mileage used for business. However if the vehicle was used for a business purpose you may be able to deduct some or all of the cost against your self-employment income. Read on for details on how to deduct car loan interest on your tax return.

Experts agree that auto loan interest charges arent inherently deductible. You cant deduct your car payments on your taxes but if youre self-employed and youre financing a car you use for work all or a portion of the auto loan interest may be tax. In order to do this your vehicle needs to fit into one of these IRS categories.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. You can deduct interest on the money you borrow to buy a motor vehicle zero-emission vehicle passenger vehicle or a zero-emission passenger vehicle you use to earn business professional farming or fishing income. Interest paid on a loan to purchase a car for personal use.

But you can deduct these costs from your income tax if its a business car. The interest on a car title loan is not generally tax deductible.

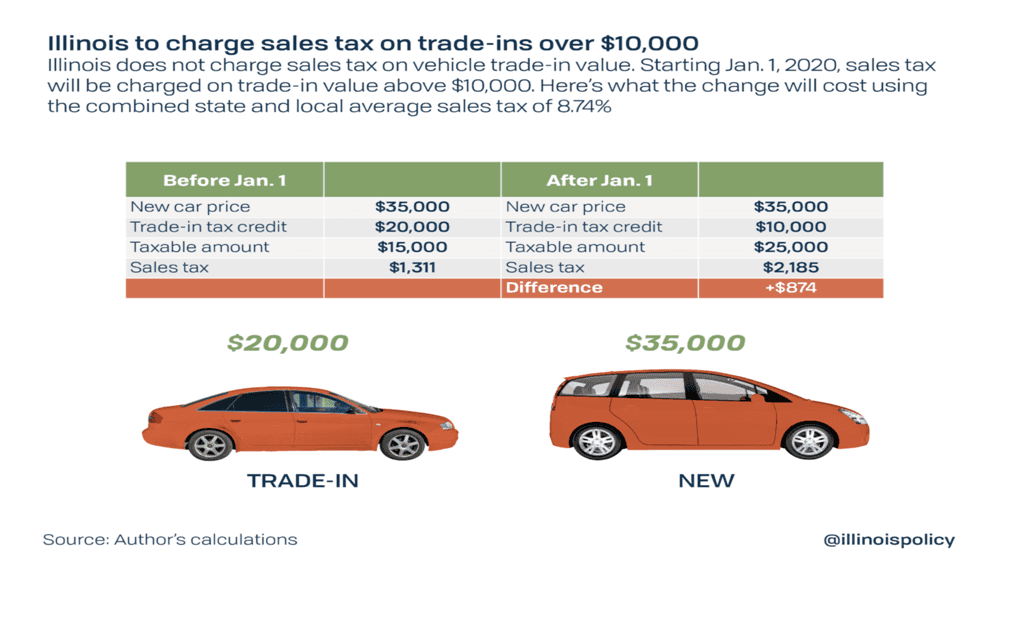

Illinois Car Trade In Tax Changes Starting January 2020 Star Nissan

Company Car Tax Benefits Implications Accounting Firm In Chicago Il

Can I Write Off My Car Payment

Are Car Repairs Tax Deductible H R Block

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Is Buying A Car Tax Deductible In 2022

How Do Electric Car Tax Credits Work Credit Karma

Is Buying A Car Tax Deductible Lendingtree

Benefit In Kind Tax On Company Cars How Much Will You Pay Maxxia

Is Buying A Car Tax Deductible In 2022

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Interesting Facts About Tax Deduction For Classic Or Antique Cars Used In Business Meese Khan Llp

Is Buying A Car Tax Deductible Lendingtree

What Car Related Tax Deductions Are Available Carvana Blog

Car Expenses You Can Deduct For Tax